Guide to Money for Young Adults

- The Bromide Team

- Oct 9, 2020

- 3 min read

Updated: Nov 14, 2020

Financial Education is a very important yet overlooked subject. In order to get good with money you need to be able to understand it hence determine how best you can apply it to your life taking into account your financial situation. When it comes to personal finance and keeping track of everything, it can seem like a daunting task just to manage the money in your account, but when it comes to financial health, you need to have a game plan. Good thing we know just where you should start, your net worth.

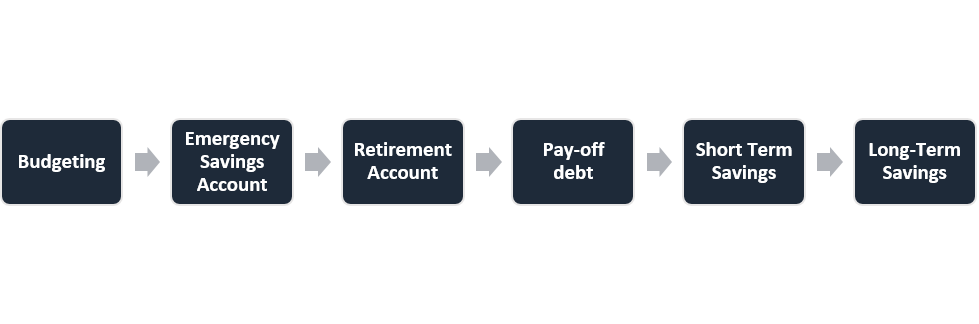

Becoming familiar with your net worth is a great place to start analyzing your financial well-being. This is basically your liabilities versus your assets. If your assets are more than your liabilities then you have a positive net worth and vice versa. Once you know where you stand, then you can decide what your financial goals are. But before we get into the details, track your income and spending for a period of time like 3 months which then give you an overview of where your money goes which then allows you to make an informed decision on your fund allocation. The following are the steps we recommend on your journey to getting good with money.

1. Budgeting

The precursor to creating a budget is to track how much you spend and save in detail i.e. income and expenses. It is recommended that you literally write down, whether on a book or a spreadsheet or on an app. Take into account each amount spend no matter how small. That way you will be able to tell if you are spending unnecessarily and hence be able to cut down on your costs.

Once you have an outline of your spending, create a budget in order of priority as outlined below:

Fundamentals – These are basic items that you cannot live without such as rent, food, utilities etc.

Security – These are Items that increase your financial stability such as Emergency Funds

Financial Goals – These are items that you aspire towards like, saving to buy a house, start a business etc.

Lifestyle – These include gym memberships, personal grooming etc.

Miscellaneous – These are whatever is leftover and subjective to each person such as entertainment.

2. Emergency Savings Account

Once you have figured out where your money goes and have cut back on unnecessary expenses (It is important to decide your savings before planning your expenses) allocate your funds towards creating an emergency fund. This is basically the amount of money you need to live comfortably for a month multiplied by 3 - 6 months. This is important so as to cushion you in the event of a job lay-off or a medical emergency not covered by the insurance.

3. Setting up a retirement Account

A few employers offer pension as part of the compensation package but for those who do now and the self-employed, it is worth taking the time and doing a bit of research into some of the offerings by different companies. Starting retirement saving early allows you the benefit of compound interest.

4. Clearing debt

Living in debt can be stressful and always eats your income. Once you have allocated funds for saving, you should also allocate money aside for clearing high-interest debts. This can take a long time so no need to stress about it. But make an effort to pay off debt such as paying the minimum amount payable so as not to incur more interest.

5. Investments and Savings Accounts

Once you are in the clear, you have more disposable income to do with as you please. We recommend looking into growing your income. This can be achieved through investing your money in various instruments or re-investing into your business. Alternatively, you could also invest in yourself by acquiring new skills either via school or courses, books etc.

Savings can be categorized into short and long term savings depending on what your goals are. How much would you like to save? Are you saving for a vacation? Are you saving to buy a house? One should always save with a specific purpose as this way the temptation to skip will be nullified.

Some additional tips include: (i) putting odd money away, such as coins or extra cash, they accumulate and turn into something substantial at the end of every month, (ii) rounding off figures spent and keeping the rest aside, (iii) always having a shopping list before going shopping to avoid impulse buys (iv) before making a big purchase, take 3 days and if after the period lapses and you still want it then buy, for bigger purchases, you can increase the time to 1 month.

Financial wellness shouldn’t be a privilege for a select few and it doesn’t have to be rocket science. Taking small but measurable steps towards your money and educating yourself about it is sure to pay off in the long term. It is never too late to start budgeting.

Comments